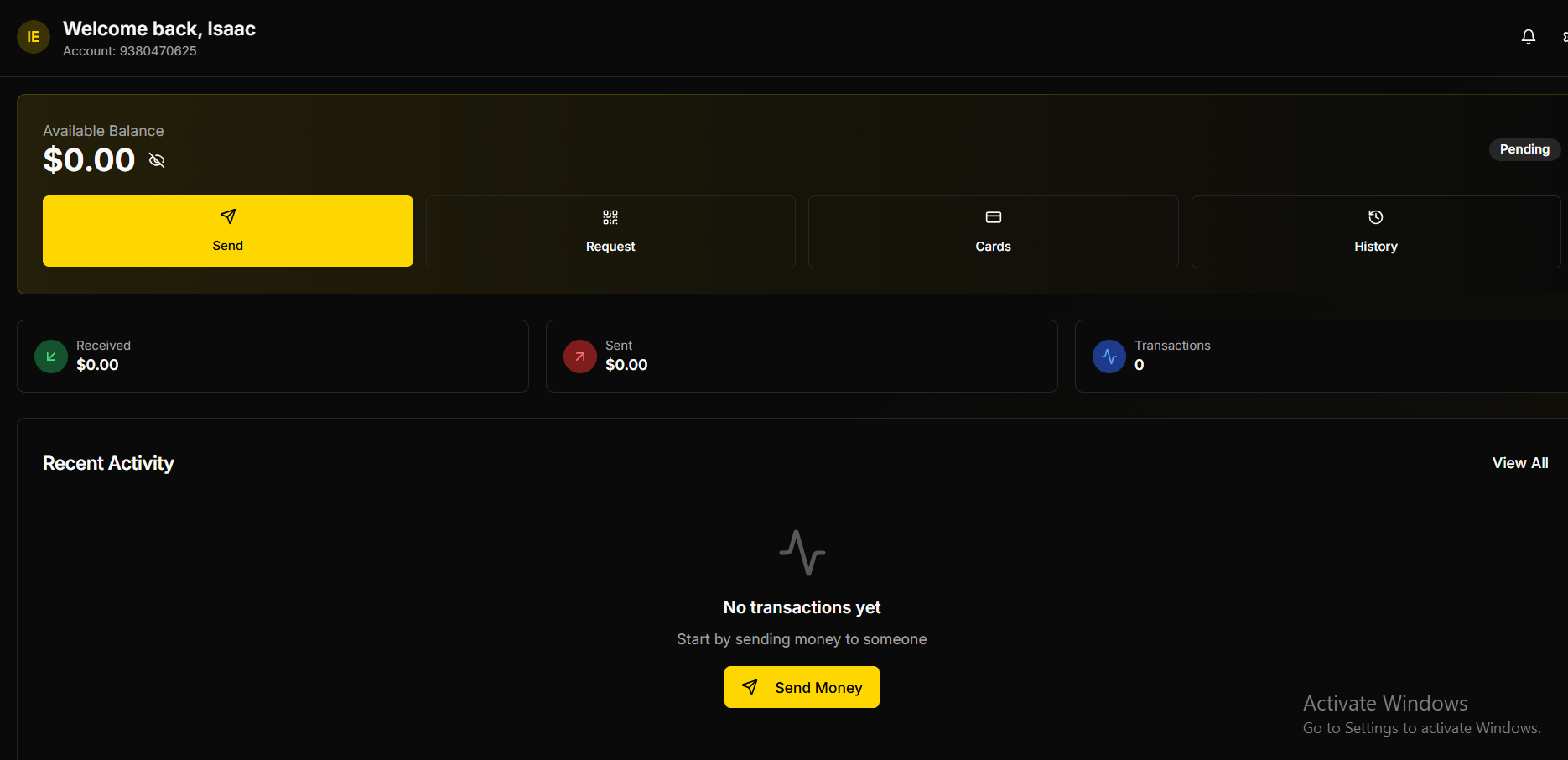

How I Design Secure Fintech Applications as a Solo Developer

Discover best practices for developing secure fintech applications. As a solo developer in Nigeria, I share my approach to building financial software that meets security standards while maintaining functionality and user experience.

Introduction: The Critical Importance of Security in Fintech

As a solo developer specializing in fintech applications in Nigeria, I've learned that security isn't an optional feature – it's the foundation upon which successful financial software is built. When handling sensitive financial data, user credentials, and monetary transactions, the stakes are incredibly high. A single security breach can destroy not only your application but also the trust of users and partners.

The unique challenges of fintech security include:

- Regulatory Compliance: Meeting PCI-DSS, CBN, and other financial regulations

- High-Value Targets: Financial applications are prime targets for cybercriminals

- User Trust: Users must feel completely confident about their financial data

- Transaction Integrity: Financial transactions must be accurate and irreversible

- Real-Time Processing: Security measures must not impede transaction speed

Understanding the Fintech Threat Landscape

Common Attack Vectors

Fintech applications face several persistent threats:

1. Man-in-the-Middle Attacks

Attackers intercept communications between users and servers to steal credentials or transaction data.

2. SQL Injection

Malicious SQL queries injected into input fields to access or manipulate database contents.

3. Cross-Site Scripting (XSS)

Injecting malicious scripts into web applications to steal user data or hijack sessions.

4. Account Takeover Attempts

Using stolen credentials or security vulnerabilities to gain unauthorized access to user accounts.

5. Fraudulent Transactions

Attempting to process unauthorized or fake transactions through the system.

Nigerian-Specific Considerations

Operating in Nigeria presents unique security challenges:

- Regulatory Requirements: Complying with Central Bank of Nigeria (CBN) regulations

- Infrastructure Issues: Unreliable power and internet affecting security protocols

- Cultural Factors: Understanding local fraud patterns and social engineering tactics

- Regional Regulations: Navigating state and federal financial regulations

My Security-First Development Framework

1. Secure Architecture Design

Building security into the foundation of every application:

Zero-Trust Architecture

- Verify all requests regardless of origin

- Implement multiple layers of authentication

- Assume that any component could be compromised

Defense in Depth

- Multiple security controls at different layers

- Network, application, and data-level protections

- Redundant security measures to prevent single points of failure

Separation of Concerns

- Isolate critical financial functions

- Separate user data from transaction processing

- Implement proper access controls between system components

2. Data Protection Strategies

Protecting sensitive financial information throughout its lifecycle:

Encryption at Rest

- Encrypt all stored financial data using AES-256

- Secure encryption keys separately from data

- Regular rotation of encryption keys

Encryption in Transit

- Mandatory TLS 1.3 for all communications

- Certificate pinning for mobile applications

- Secure API communication protocols

Data Minimization

- Collect only necessary data for specific functions

- Anonymize data where possible for analytics

- Secure deletion of unnecessary data

3. Authentication and Authorization

Robust user verification and permission systems:

Multi-Factor Authentication (MFA)

- SMS, email, and authenticator app options

- Hardware security key support

- Biometric authentication where available

Role-Based Access Control (RBAC)

- Granular permissions for different user types

- Principle of least privilege

- Regular access reviews and updates

Session Management

- Secure session tokens with proper expiration

- Concurrent session controls

- Automatic logout for inactive sessions

Implementation Best Practices

Secure Coding Standards

Following established security practices in every line of code:

Input Validation

- Server-side validation for all inputs

- Sanitization of user-provided data

- Whitelist validation where possible

- Proper encoding to prevent injection attacks

Error Handling

- Generic error messages to avoid information disclosure

- Comprehensive logging without exposing sensitive data

- Graceful degradation of functionality

Dependency Management

- Regular updates of third-party libraries

- Vulnerability scanning of dependencies

- Minimal dependency footprint

API Security

Securing application programming interfaces that connect financial services:

Rate Limiting

- Prevent brute force and denial-of-service attacks

- Account for legitimate usage patterns

- Dynamic adjustment based on user behavior

API Keys and Tokens

- Unique keys for each application integration

- Regular rotation of API credentials

- Proper storage and transmission of keys

Request Signing

- Cryptographic signing of API requests

- Timestamp validation to prevent replay attacks

- Nonce usage to ensure request uniqueness

Database Security

Protecting the financial data repository:

Access Controls

- Dedicated database users for different application components

- Network restrictions on database access

- Audit logging of database activities

Query Security

- Parameterized queries to prevent injection

- Proper indexing for performance without exposing data

- Regular security patches and updates

Tools and Technologies I Use

Security Testing Tools

- OWASP ZAP: Automated security testing for web applications

- Burp Suite: Manual security testing and vulnerability analysis

- SonarQube: Static code analysis for security vulnerabilities

- Snyk: Dependency vulnerability scanning

Monitoring and Alerting

- SIEM Solutions: Real-time security event monitoring

- Anomaly Detection: Identifying unusual user behavior patterns

- Transaction Monitoring: Flagging suspicious financial activities

- Log Aggregation: Centralized security logging and analysis

Compliance Management

- PCI-DSS Compliance Tools: Automated compliance checking

- Audit Trail Systems: Comprehensive activity logging

- Policy Management: Automated enforcement of security policies

Real-World Security Implementation Example

Case Study: Secure Payment Processing System

A recent project required building a payment processing system for a Nigerian e-commerce platform. Here's how I implemented security measures:

Authentication Layer

// Multi-factor authentication implementation

const authenticateUser = async (credentials, mfaToken) => {

// Verify primary credentials

const user = await verifyCredentials(credentials);

if (!user) throw new AuthenticationError('Invalid credentials');

// Validate MFA token

const isValidMFA = await validateMFAToken(user.id, mfaToken);

if (!isValidMFA) throw new AuthenticationError('Invalid MFA token');

// Generate secure session token

return generateSecureSession(user.id);

};

Transaction Security

- Idempotency Keys: Preventing duplicate transactions

- Transaction Signing: Cryptographic verification of transaction integrity

- Real-time Fraud Detection: Machine learning models to identify suspicious patterns

Data Protection

- Tokenization: Replacing sensitive card data with secure tokens

- End-to-End Encryption: Protecting data throughout the transaction process

- Audit Trails: Comprehensive logging of all financial operations

Security Testing Process

Every fintech application undergoes rigorous security testing:

Automated Testing

- Static application security testing (SAST)

- Dynamic application security testing (DAST)

- Interactive application security testing (IAST)

Penetration Testing

- Third-party security audits

- Ethical hacking assessments

- Vulnerability assessments

Compliance Verification

- PCI-DSS compliance checks

- Regulatory requirement validation

- Internal security audits

Regulatory Compliance in Nigeria

Central Bank of Nigeria (CBN) Requirements

- Payment Service Providers Regulations: Compliance for payment applications

- Consumer Protection Framework: Safeguarding user rights and data

- Cybersecurity Framework: Minimum security standards for financial institutions

International Standards

- PCI-DSS: Payment Card Industry Data Security Standard

- ISO 27001: Information Security Management

- SOC 2: Security and Availability standards

Documentation Requirements

- Security Policies: Comprehensive security documentation

- Incident Response Plans: Procedures for security incidents

- Risk Assessments: Regular evaluation of security risks

Maintaining Security as a Solo Developer

Challenges of Solo Development

Working alone on fintech security presents unique challenges:

Resource Constraints

- Limited budget for security tools

- Time constraints for comprehensive testing

- Single point of security knowledge

Knowledge Gaps

- Difficulty staying current with all security developments

- Limited peer review opportunities

- Potential oversight of security blind spots

Strategies for Success

Continuous Learning

- Regular training and certification updates

- Participation in security communities

- Following security blogs and news sources

Automation and Tools

- Investing in security automation tools

- Using cloud-based security services

- Implementing security as code practices

Outsourcing Strategic Areas

- Third-party penetration testing

- Security audit services

- Compliance verification services

Common Security Pitfalls to Avoid

Development Mistakes

- Hardcoded Secrets: Never embed credentials in source code

- Insufficient Input Validation: Always validate on the server side

- Weak Password Storage: Use bcrypt or similar for password hashing

- Insecure Direct Object References: Implement proper access controls

Operational Oversights

- Inadequate Logging: Maintain comprehensive security logs

- Poor Incident Response: Have clear procedures for security incidents

- Missing Security Updates: Regular patching of systems and dependencies

- Weak Access Controls: Implement proper segregation of duties

Performance vs. Security Balance

Optimizing Security Measures

Security shouldn't compromise user experience:

Efficient Authentication

- Streamlined MFA processes

- Intelligent authentication challenges

- Behavioral analysis for risk-based authentication

Transaction Processing

- Optimized cryptographic operations

- Caching of secure data where appropriate

- Asynchronous security checks where possible

User Experience

- Clear security indicators to build user confidence

- Transparent security processes

- Minimal disruption to legitimate users

Future-Proofing Security

Emerging Threats

Staying ahead of evolving security challenges:

Quantum Computing Risks

- Preparing for post-quantum cryptography

- Evaluating quantum-resistant algorithms

- Planning migration strategies

AI-Powered Attacks

- Defending against AI-enhanced social engineering

- Protecting against automated attack tools

- Implementing AI-based anomaly detection

Regulatory Evolution

- Monitoring new security requirements

- Adapting to changing compliance standards

- Preparing for international expansion requirements

Conclusion: Security as Competitive Advantage

In fintech development, security isn't just a requirement – it's a competitive advantage. Users will only trust financial applications that demonstrably protect their money and personal information. As a solo developer in Nigeria, I've found that prioritizing security from the beginning of every project not only protects users but also builds trust and credibility that leads to more business.

The key to successful secure fintech development as a solo developer is implementing comprehensive security measures while maintaining focus on user experience and business functionality. This requires continuous learning, strategic use of security tools, and a commitment to staying current with evolving threats and regulations.

Security is an ongoing journey, not a destination. Each project teaches new lessons about protecting financial data and maintaining user trust. By following security-first principles and implementing robust protective measures, solo developers can create fintech applications that stand up to the highest security standards while delivering the functionality users need.

Ready to build a secure fintech application? Contact RitchieTech to discuss how security-first development can protect your users and build trust in your financial application.

RitchieTech

Full-Stack & Fintech Software Developer

Liked this article?

Get in touch to discuss your fintech project or ask questions about the topics covered.

Related Articles

No related articles available.